(Versions in عربي)

It was an early spring morning in East Jerusalem in 2011, and we were wrapping up our two-week mission with a presentation to donor representatives on the Palestinian economy’s health. Our audience appeared encouraged by our assessment of performance over the previous three years (2008–10): the economy had been recovering strongly, supported by generous aid and an easing of Israeli restrictions on movement and trade.

And the Palestinian Authority had made impressive progress in institution-building, which alongside prudent fiscal management, had enhanced public-sector efficiency, reduced wasteful expenditure, and enabled a reduction in its recurrent budget deficit from US$1.7 billion in 2008 to US$1.1 billion in 2010.

But the mood in the room became less upbeat as our discussion turned to the risks facing the economy. Donor aid had started to fall below the amounts needed to finance the Palestinian Authority’s already tight budgets. The decline appeared to be driven largely by donor fatigue from a deadlocked peace process, rising global economic challenges, and competing aid needs of countries in the region with the onset of what became known as the Arab Spring.

Today, two years later, the Palestinian Authority is facing a major fiscal crisis that is raising social tensions and threatening its operations.

The donor aid shortfalls, worsened by repeated delays in the transfer of clearance revenues (which are indirect taxes collected by Israel on behalf of the Palestinian Authority) have led to a rapid buildup of domestic payments arrears and borrowing up to domestic commercial banks’ limits. The drop in aid, coupled with the persistence of restrictions on trade and movement of goods and people, has also hurt economic growth and contributed to an increase in unemployment.

The Palestinian Authority’s financing difficulties will have severe negative consequences unless they are addressed quickly. Given its limited scope for further arrears and debt accumulation, the Palestinian Authority would be forced to cut public-sector wages and core operating expenditures. This would severely impair its operations, and could erode the institutional gains of recent years. There have already been repeated delays in the payment of public-sector wages, which have led to recurrent strikes in ministries and government agencies. In addition, there is a risk that assistance targeted to the needy will be curtailed, further fueling social tensions. Finally, the buildup of domestic arrears is bound to weaken private-sector confidence in the government’s ability to meet its payment obligations.

Concerted action by the Palestinian Authority, Israel, and the international community are needed to address the immediate fiscal crisis and help support a lasting recovery in Palestinians’ living standards.

First, the Palestinian Authority needs to prepare for the possibility of continued shortfalls in aid by containing the budget deficit. To that end, several measures are key, including increased restraint on the public-sector wage bill and better targeting of employee allowances. Other expenditures should continue to be prioritized, and cash management strengthened to ensure that nonessential spending takes the brunt of cuts.

Tax administration should continue to be enhanced by widening the tax base and improving compliance. It is also important to press ahead with civil service and pension reforms and to strengthen the legal framework facing businesses.

Second, the understandings reached in mid-2012 between the Palestinian Authority and Israel on measures to enhance the collection of clearance revenue and ensure its timely transfer to the Palestinian Authority are important steps in bilateral economic cooperation and should be implemented promptly, given that clearance revenue represents the bulk of the Palestinian Authority’s income.

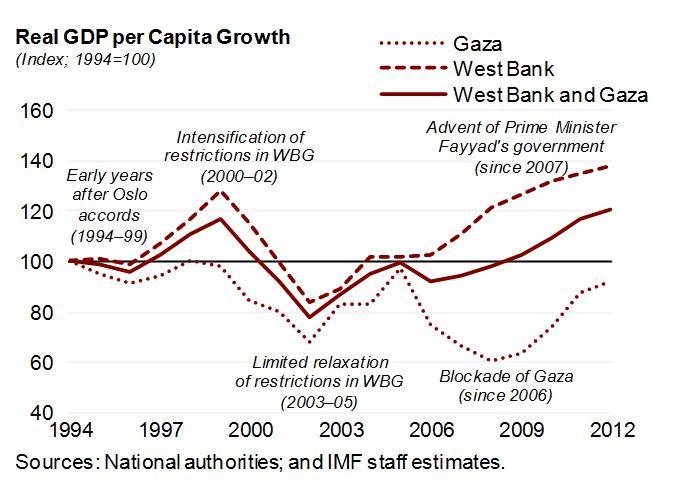

A broadening of that cooperation to include an easing of Israeli restrictions on external trade and movement of goods and people in the West Bank and Gaza is essential to expand private-sector growth and employment and to reduce the Palestinian Authority’s reliance on aid. Over the past two decades, real GDP per capita has been substantially influenced by the extent of such restrictions (see figure).

Finally, it is critical for the international community to re-engage in supporting the economic development of the West Bank and Gaza, in particular by providing a framework for economic cooperation between Palestinians and Israelis.

More immediately, it is important that the Palestinian Authority’s efforts be complemented by the prompt disbursement of additional donor aid to prevent a further buildup of arrears and debt to commercial banks, and avoid a serious disruption of the Palestinian Authority’s core operations. Timely disbursement of aid is essential for sustaining an orderly path of budget deficit reduction and institution-building toward a self-reliant Palestinian state.